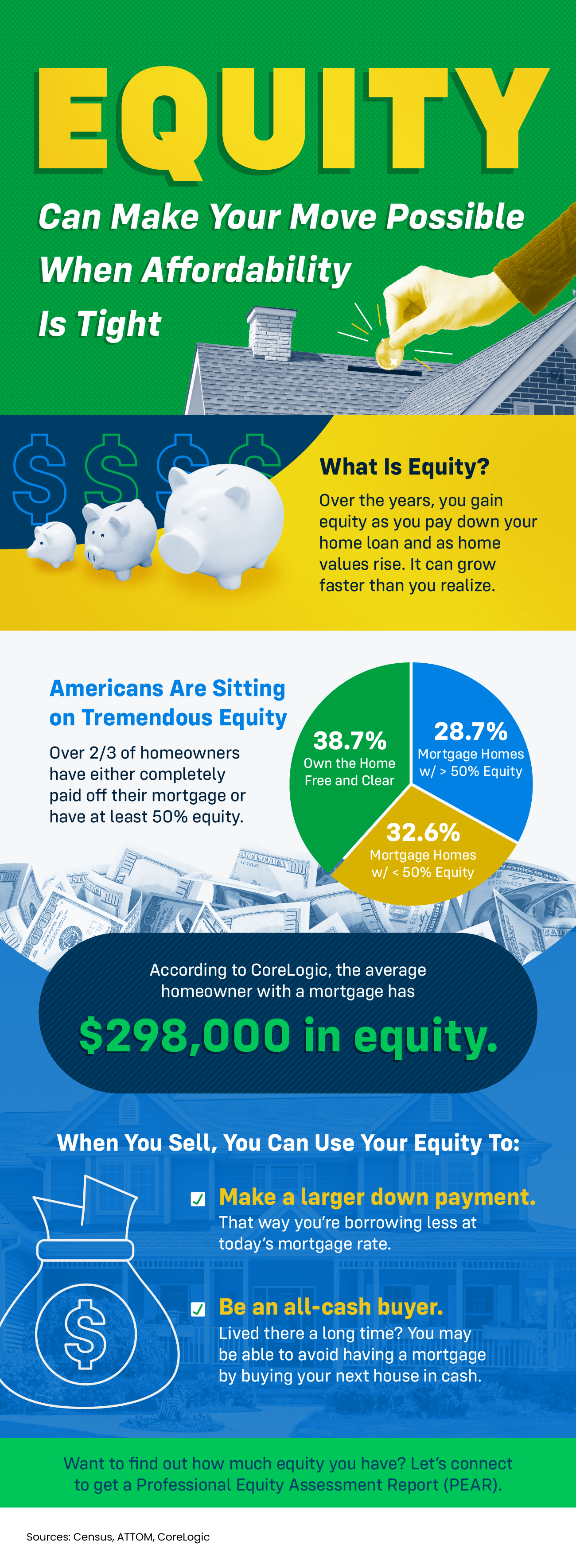

Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC]

![Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC] Simplifying The Market](https://img.chime.me/image/fs/chimeblog/20240427/16/original_0d1e2262-4d9f-4624-af9f-1f2b665f4991.png)

Some Highlights

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

Categories

Recent Posts

Multi-Generational Homebuying Hit a Record High – Here’s Why

What Every Homeowner Needs To Know In Today’s Shifting Market

Think It’s Better To Wait for a Recession Before You Move? Think Again.

Why Your Home's Asking Price Matters More Today

Why Homeownership Is Going To Be Worth It

3 Reasons To Buy a Home This Summer

Why More Sellers Are Choosing To Move, Even with Today’s Rates

What You Really Need To Know About Down Payments

Why Most Sellers Hire Real Estate Agents Today

You May Have Enough Equity To Downsize and Buy Your Next House in Cash

Whether you're trying to buy your dream home or selling your current one, LPT Realty's number one priority is to help find you the best deal possible while providing exceptional customer service. LPT Realty agents are armed with best in class technology and marketing tools to help you make informed decisions about buying or selling your home, and are there for you every step of the way.